Maldives Tax

Income tax bill of maldives has been passed in the 74th sitting of the peoples majilis parliament of maldives on 4th december 2019.

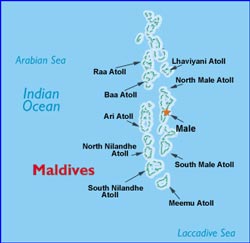

Maldives tax. Green tax is payable at the rate of 6 united states dollars per day of stay from tourist resorts tourist hotels and tourist vessels and 3 united states dollars per day of stay from tourist guesthouses. According to mira any income derived by a resident in the maldives is subject to tax in the maldives irrespective of where the income is sourced. Tax on profits of banks operating in the maldives is levied under the bank profit tax act act no.

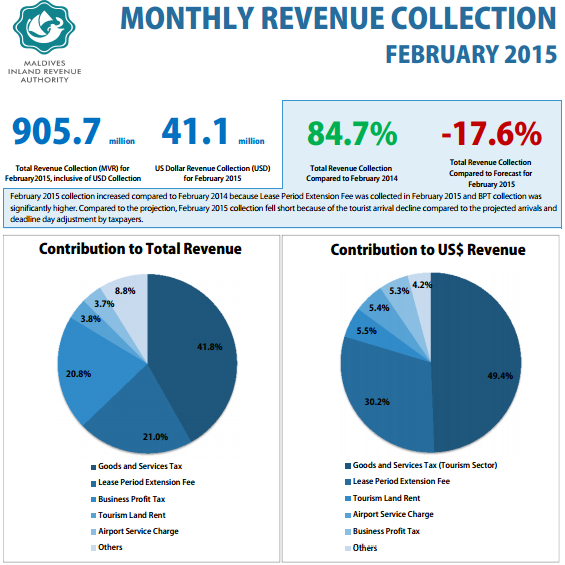

The main responsibilities of mira include execution of tax laws implementation of tax policies and providing technical advice to the government in determining tax policies. The withholding tax is charged in the amount of 10. Corporate tax rate in maldives averaged 618 percent from 2004 until 2020 reaching an all time high of 15 percent in 2014 and a record low of 0 percent in 2005.

The maldives general gst goods services tax is 6. Nisab for zakat al mal. In general the maldives are considered a very favourable tax environment for both work and business.

Employee withholding tax brackets and corresponding tax rates. Green tax liable tourist establishments will be automatically registered for green tax in the name of the operating license holder from the date on which the ministry of tourism issues the operating license. 985 and administered through the bank profit tax regulation.

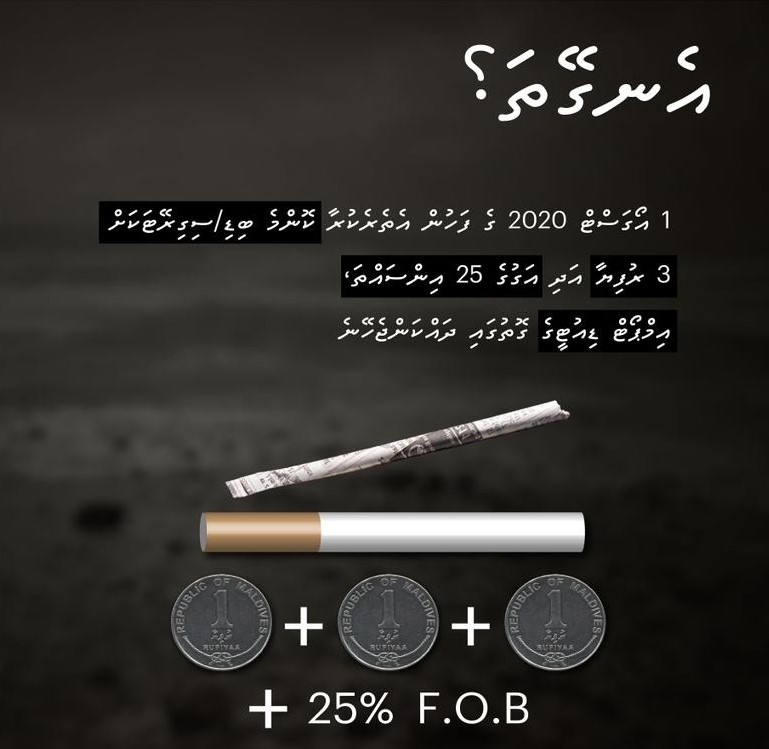

Registration for bank profit tax purposes all commercial banks operating in the maldives would be registered with the mira once they are granted with the license to operate by the maldives monetary authority. Income tax will commence from 1st january 2020 while the tax on employment income will be effective from 01st april 2020 onward. Maldivians and resident permit holders are not required to pay green tax.

With relatively low tax rates and a very straightforward way to pay taxes you should have no problem adjusting to the system. The maldives inland revenue authority mira is a fully autonomous body responsible for tax administration in the maldivesmira collected 781 of the total revenue collected by the government of maldives in 2018. Mvr 495040 for zakat computation queries call.

Taxable income includes allowances and benefits received by an employee whether received in cash or in kind. Consumption taxes in maldives maldives has multiple consumption taxes which apply in different situations depending on what purchase is being made. Since income tax bill is designed to charge tax from personal income and profit earned from businesses covering the broad spectrum of income earned from entities in maldives by local and foreign individuals and businesses the.

The corporate tax rate in maldives stands at 15 percent. 2 of the gross amount of income specified in section 11r of the income tax act in a tax year.

Business Profit Tax Bpt Mira Maldives Inland Final Bpt Maldives Inland Revenue Authority Hotline 1415 Tel 332 2261 E Mail 1415 Mira Gov Mv Website Business Profit

dokumen.tips