Maldives Tax Haven

When it comes to everything else remember you are still in a resort so whatever you buy is from the resort which usually equals that little bit extra.

Maldives tax haven. Box 523034 springfield va 22152 paypal. The maldives is a fascinating country to travel to independently not least because its only been possible to do so for the past decade. Irelands aggregate effective tax rates for foreign corporates is 2245.

Hmm yes the big problem of the maldives. Ireland has been labelled a tax haven or corporate tax haven in multiple reports an allegation which the state rejects. Let me start by saying that i havent found any official mention of this on the countrys website but rather im going off a story from the telegraph which uses ali wahed the minister of tourism of the maldives as a sourcehe has outlined a plan to welcome back tourists as of july 1 2020 when commercial flights to the country are scheduled.

In the long term the brazil sales tax rate vat is projected to trend around 1700 percent in 2021 according to our econometric models. It was adopted for the first time in 2017 as a response to tax avoidance in the eu screening 92 countries. To donate by check please make payable to the catholic thing and mail to.

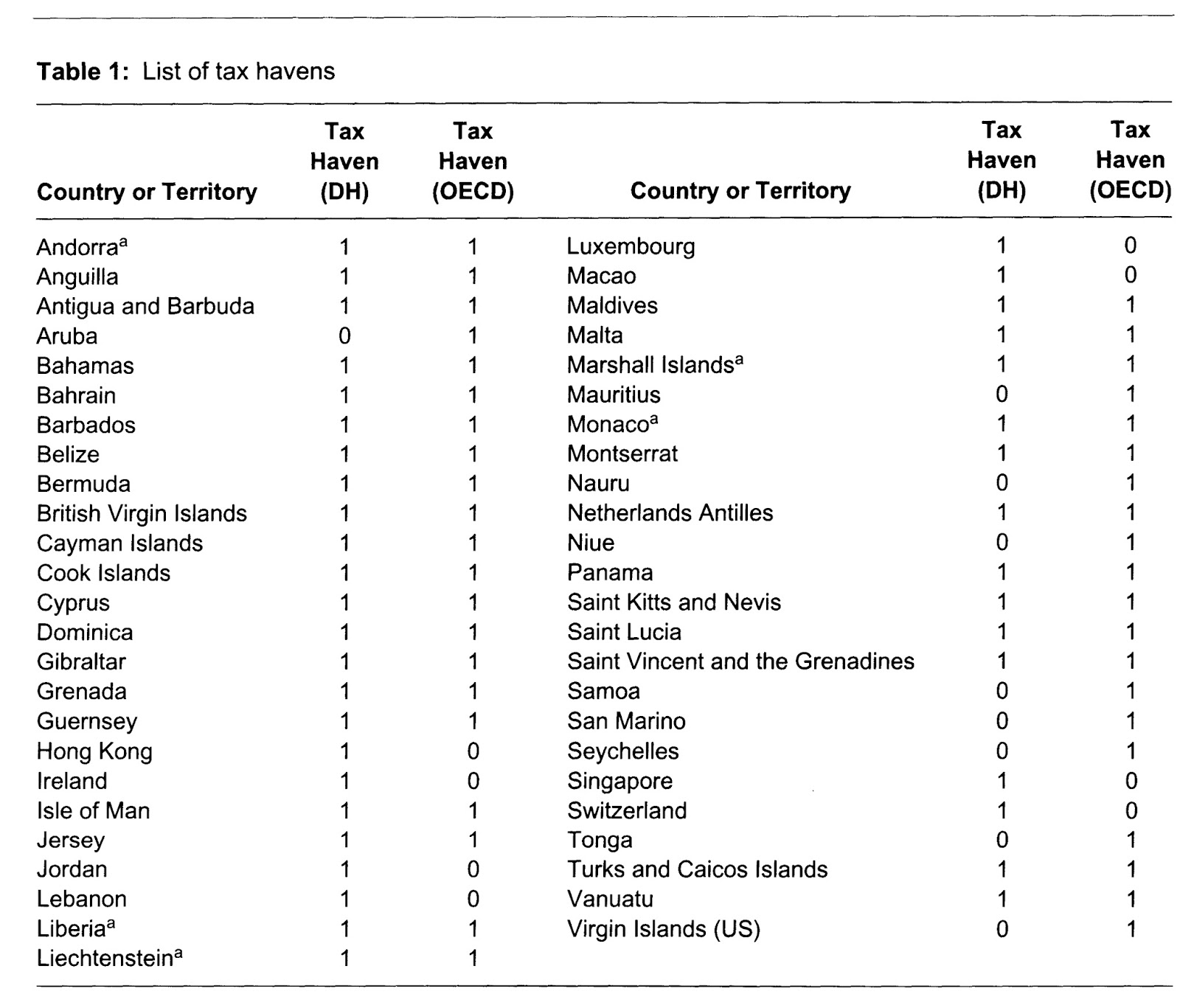

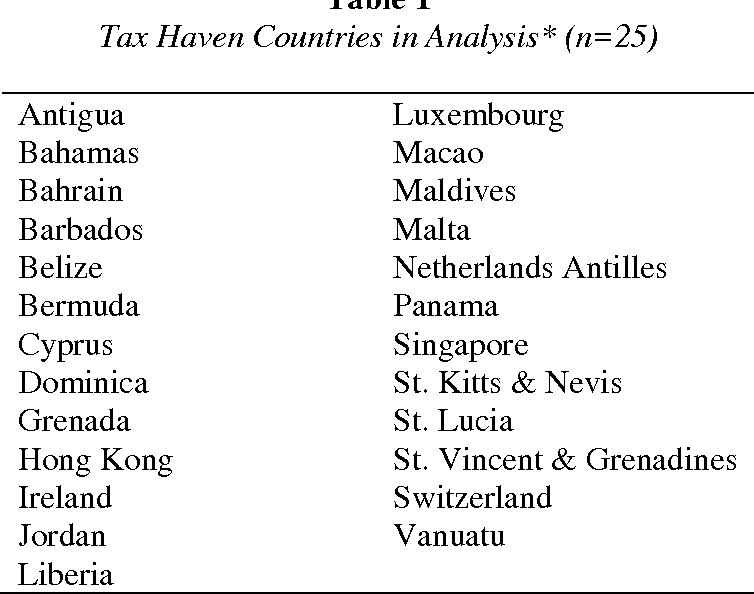

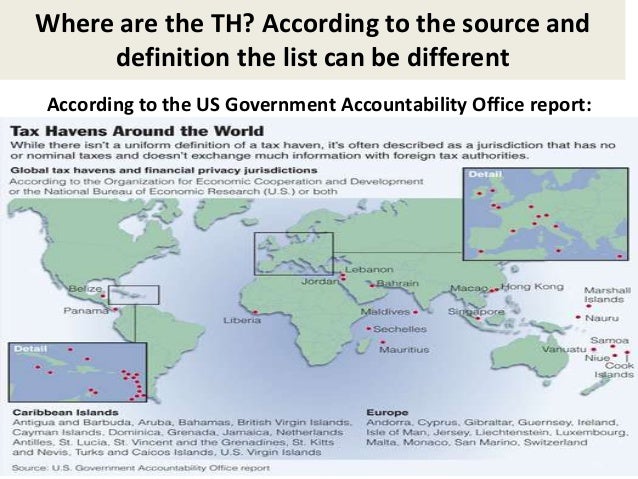

Now guesthouses are springing up on local islands on a weekly basis offering budget travellers an affordable way to explore the country. Between 2000 and april 2002 31 jurisdictions made formal commitments to implement the oecds standards of transparency and exchange of information. Well dont forget the tax 12 tax us 600 environmental fee per person per night us 20200 shuttle fee per person per stay.

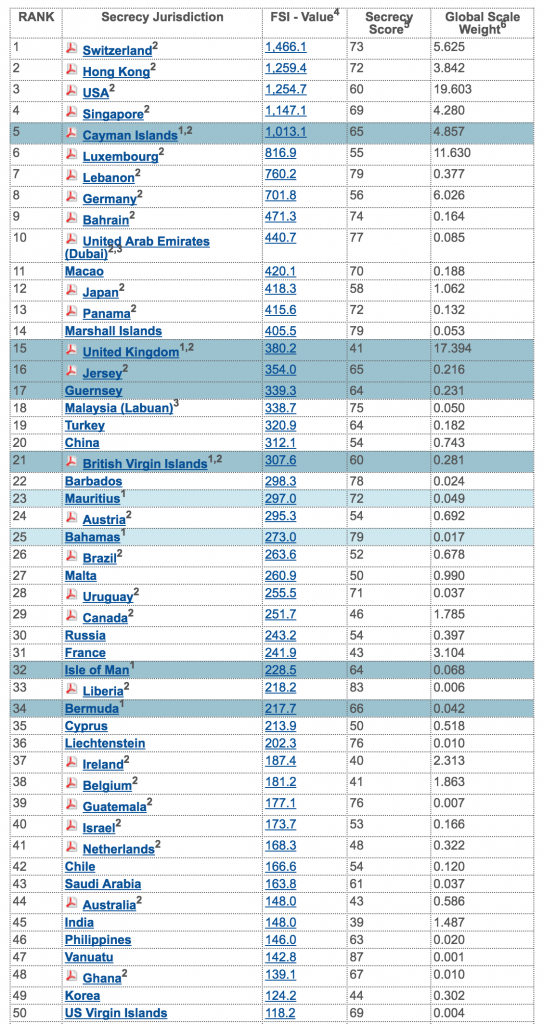

Seven jurisdictions andorra the principality of liechtenstein liberia the principality of monaco the republic. The cost of a trip to the maldives if you plan to stay on local islands only and then the cost of a trip to the maldives if you plan to stay in luxury resorts on private islands. The european union tax haven blacklist officially the eu list of non cooperative tax jurisdictions is a tool of the european union eu that lists tax havensit is used by the member states to tackle external risks of tax abuse and unfair tax competition.

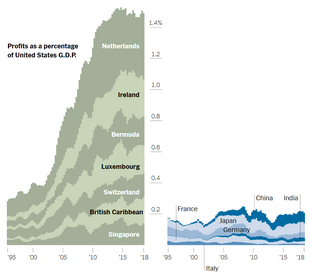

Irelands base erosion and profit shifting beps tools give some foreign corporates effective tax rates of 0 to 25 on global profits re routed to ireland via their tax treaty network. Maldives may reopen to tourists on july 1. You can technically do that in the maldives a small island country in the indian ocean.

Living permanently in kuwaits tax free haven then is near impossible so i wouldnt base your tax strategy here. It should also be noted that there are over 200 luxury resorts and the prices vary enormously depending on how exclusive or upmarket it it.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsuiypo5mpm0osjuzozyiqv67f9d70vb Bmzhjtvsspnbf1naah Usqp Cau

encrypted-tbn0.gstatic.com

Dubai Wealth Managers Dismiss Uae Inclusion In Eu Tax Haven Blacklist The National

www.thenational.ae

:max_bytes(150000):strip_icc()/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)