Zakat Maldives

Collection of zakat al mal effective 1 june 2016 zakat al mal is collected at mira.

Zakat maldives. Nisab for zakat al mal. In addition to the taxpayer service centre zakat al mal can also paid at one of the branches or collection centres of mira established outside male city. Surrounded by beautiful islands maldives actually has big potential of zakat.

Zakat payment in the maldives has traditionally been voluntary but the new bill makes the annual payment compulsory and imposes a jail term of five years or a fine of mvr500000 for non compliance. Mvr 495040 for zakat computation queries call. It is not mandatory to disclose the zakat payers information to the authority ies and the zakat payers information are not recorded.

The funds received in the form of zakat and non zakat charity shall be deposited in the baitul maal as a separate specialised account with the the maldives monetary authority. As part of the governments recovery plan due to the covid 19 outbreak bank of maldives has partnered with the ministry of finance to support the implementation of the covid 19 recovery scheme. Four online platforms have been established for this purpose.

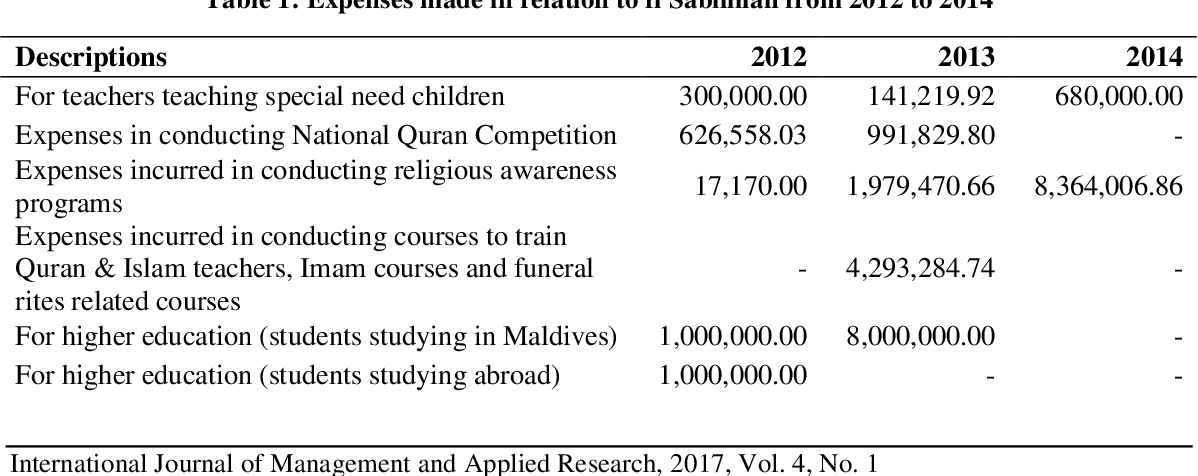

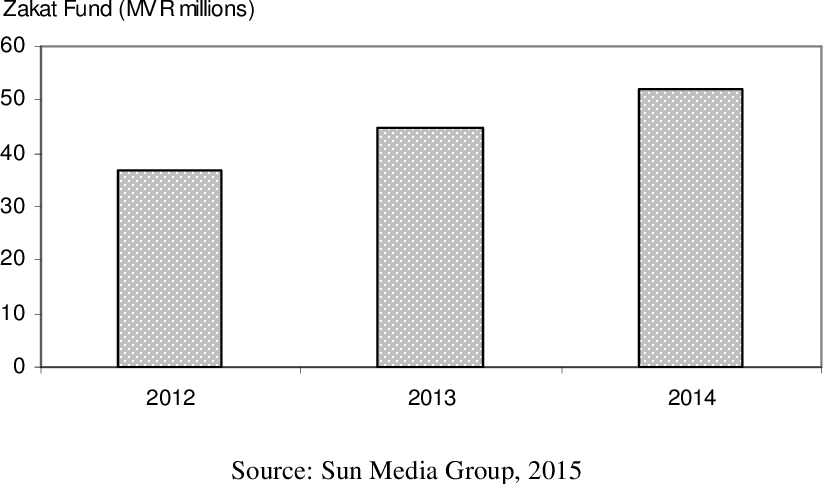

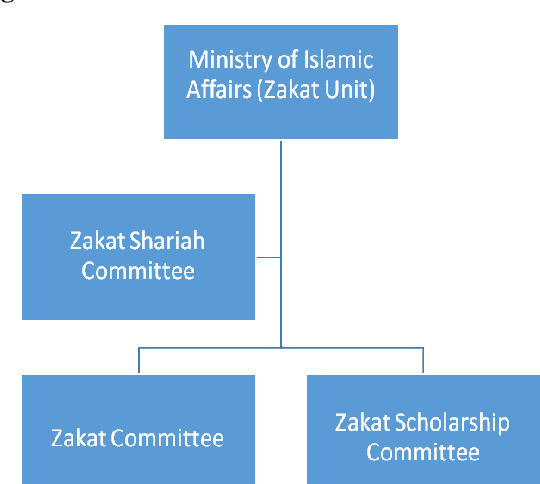

We will administer the funds allocated to resorts as well as any other businesses with over mvr 10 million turnover. Zakat collection in maldives is made by ministry of islamic affairs for male city and by the atoll and island councils for other islands of the country. The ministry of islamic affairs has revealed that they will be collecting funds for zakat al fitr online from the greater male region this year.

In the response to world zakat forum and its upcoming conference and annual meeting dr ahmed ziyad the minister of islamic affairs of maldives has indicated his willingness to participate in the world zakat forum event. As such arrangements have been made for residents of the greater male region to efficiently make their zakat payments online. Funds as stated in para 1 of this article shall not be mingled with other sources of government funds.

Mira 510 form which is available on our website is to be used for the payment of zakat al mal.