Maldives Gst

Maldivess general vat rate is 6 with other rates including 0 that can apply to certain transactions.

Maldives gst. The act brings within its scope the current tourism goods and services tax t gst regime. Acetylene is burned with oxygen to create intense heat and is used mainly for welding and cutting processes. Tourism gst remains 6 to sales and immovable property.

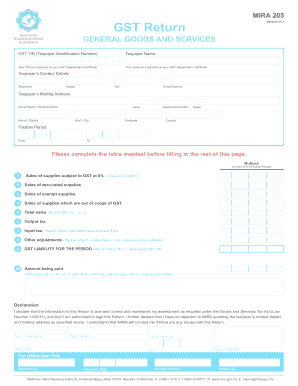

Gst is charged under the goods and services tax act law number 102011. Goods and services tax gst is a tax charged on the value of goods and services supplied in the maldives from 2 october 2011 onwards. Maldive gas takes pride in being able to supply our clients with acetylene cylinders that m.

Please do not refresh your browser. Zero rated goods and services in maldives essential goods specified in the gst act are taxable at 0. Nisab for zakat al mal.

Current gst rate in maldives is 6 for goods and services. Mvr 495040 for zakat computation queries call. It is probably the biggest tax reform since 1947 when india become gained independence from british empire.

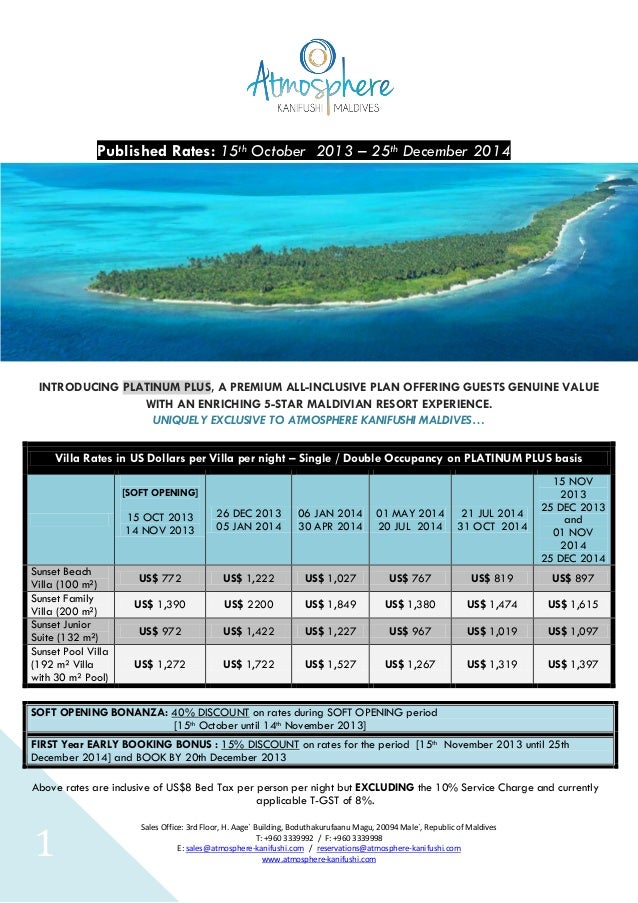

Maldives gst calculator gstguide maldivian gst calculator provides gst calculators for several countries like maldives malaysia australia egypt india canada new zealand singapore. The tgst which applies to tourism services is 12. Maldives inland revenue authority mirain male.

The maldives general gst goods services tax is 6. A standard rate of 6 value added tax is collected for goods and services. There is also 12 tourism goods and services tgst.

India introduced gst in july 2017 it took almost 17 years to introduce gst in india but at last it was launched. The 6 gst tax rate in maldives was first introduced in january 1st 2012 which has been increased to a rate of 8 from january 2013.

Mira On Twitter Today Is The Deadline For Submission Of Gst And Green Tax Returns And Payment For The Month Of April 2018

twitter.com

Maldives Maldives Technical Assistance Report Reform Options To Strengthen Tax Policy

www.elibrary.imf.org

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrcvrot22lvdcuzuzvcjrn5kyhklfievky9c9avovlb89cm4r4z Usqp Cau

encrypted-tbn0.gstatic.com